9 Best Trading Strategies for UK traders

Published on: 14/04/2023 | Modified: 16/01/2024

One of the key things to do when you start learning to trade is knowing your trading strategies. Trading strategies are specific methods that traders use when buying and selling currencies, stocks and commodities to profit from price fluctuations. Trading strategies strive to predict where the market is going, and they are often based on technical analysis or fundamental analysis.

When making informed trading decisions, traders can use a variety of different trading strategies. Below are some examples:

- 1. News trading strategy

- 2. Trend following trading strategies

- 3. Breakout trading strategies

- 4. Range trading strategies

- 5. Scalping Trading Strategy

- 6. EOD Trading Strategy

- 7. Swing Trading Strategy

- 8. Day Trading Strategy

- 9. Sniper Trading Strategy

Content Links

1. News trading strategy

News trading strategy involves taking advantage of market volatility which can happen when news is released. When using this strategy, traders might trade the financial instruments that are the most likely to be influenced by the news. For example, forex markets around interest rate announcements. Or stocks for company annual results. Some traders use fundamental analysis to try to predict market news and its impact. However, often it is more prudent to await the news and then take a position once you have a clear market trend.

2. Trend following trading strategies

Trend following trading strategies involve identifying which direction that the market trends are going and then making trades in the same trend direction. So, looking to buy markets in an uptrend or sell markets in a downtrend. Traders that use this type of strategy are more likely to use moving averages or other technical indicators as well as price charts to spot trends and enter trades.

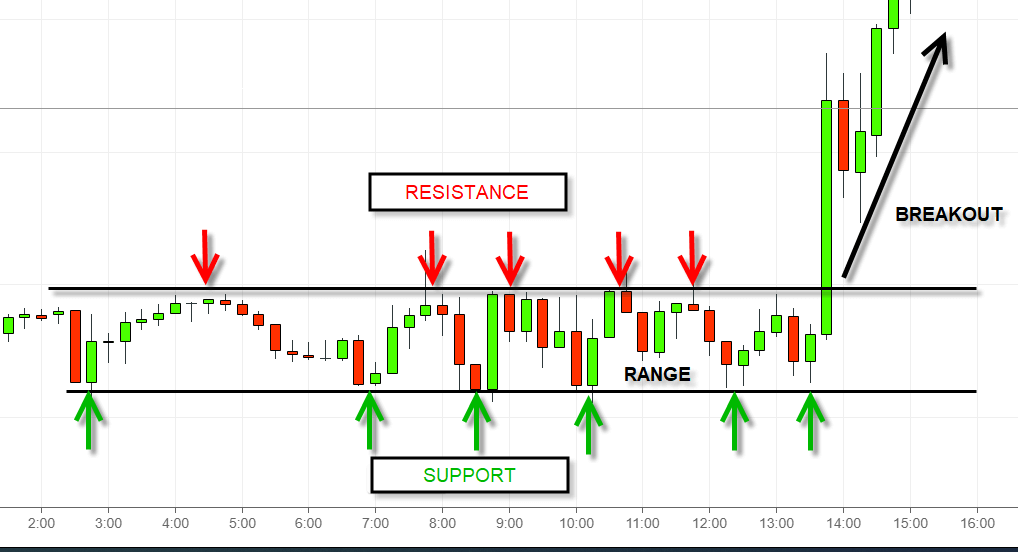

3. Breakout trading strategies

Breakout trading strategies are used by traders to identify specific levels of support and resistance and enter trades when the price breaks through these levels. Using technical indicators like Bollinger Bands or Donchian Channels on their charts, traders can identify these key levels.

4. Range trading strategies

Range trading strategies can help identify a range of the top and bottom of a market and look to profit from the price trading within that range. When traders implement this strategy, they use technical indicators such as Relative Strength Index (RSI) or Stochastic Oscillator or simply support and resistance lines drawn on to their charts to identify when the price is at the top or the bottom of the range. The idea is to buy the market at the bottom of the range and sell it at the top of the range and profit from the difference.

5. Scalping Trading Strategy

Scalping trading strategy compels traders to enter and exit trades quickly and make small profits on many different trades. Typically, traders would use very short time-frame charts for this type of trading, such as 1-minute or tick by tick charts. Using moving averages or RSI, traders can identify short-term price movements.

6. EOD Trading Strategy

End of day (EOD) trading strategy is very popular amongst stock market traders. It involves making trades towards the end of the day, when most of the market action and news has already happened. It is about entering new positions based on how the market moved during the day and how it might move the next day based on that price action. An EOD strategy might be attractive to people who have full-time jobs or other commitments during the day and can only look at their trading screens at the end of the day.

7. Swing Trading Strategy

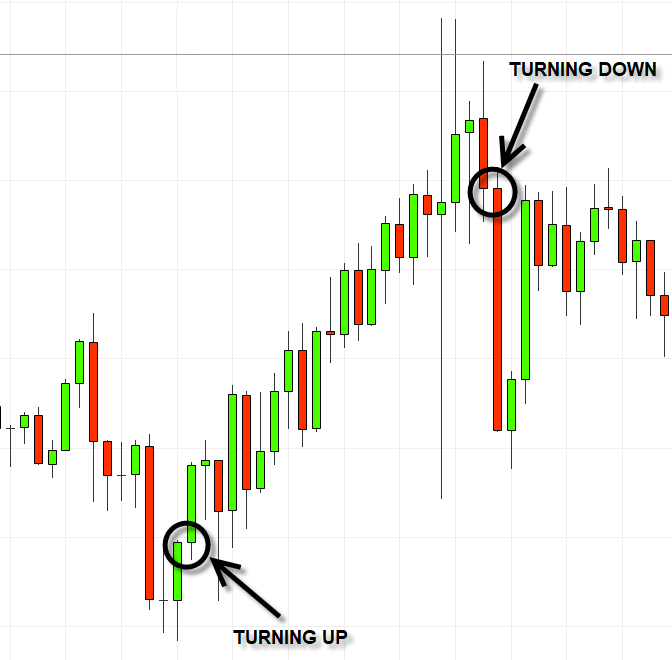

Swing trading strategy involves holding positions for a couple of days or even weeks to benefit from short-term movements or ‘swings’ in market prices. The swing trading concept is identifying trends that are expected to happen over a couple of days or weeks and then profit from these movements by entering and exiting positions at the optimum time. As with other technical analysis strategies, traders will use trendlines, support and resistance levels and other indicators to try to identify price swings and the best levels to enter and exit trades.

8. Day Trading Strategy

Day trading strategy can allow traders to make profits fast and without having to hold their positions overnight. It can be a great strategy for taking advantage of intraday market volatility. Day traders must be disciplined, focussed, and have a good understanding of market trends. Using technical analysis to observe the changing market conditions, traders must make quick decisions and be able to manage their risk and emotions.

9. Sniper Trading Strategy

The Sniper trading strategy is an end of day swing trading strategy, developed by experienced traders, that requires as little as 20 minutes per day to use. It looks to catch turning points in forex, indices and commodities markets and ride the price swings in trades typically lasting one to three days.

Learn to trade

We can teach you all of these trading strategies, helping you to improve your technical analysis, provide you with knowledge, facts and advice on trading.