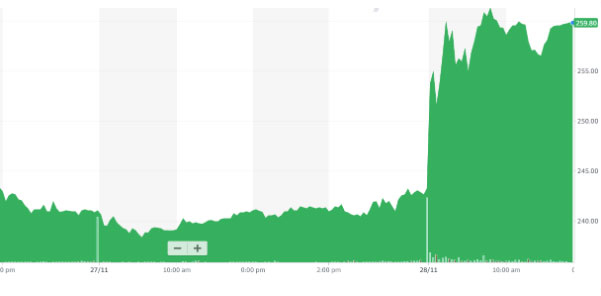

Shares of British engine maker Rolls-Royce jumped over 7% in trading today, marking the stock's largest single-day gain since mid-2021. The substantial rally comes after Rolls-Royce announced radical plans to quadruple its profits in the next four years, by streamlining the business (including selling off non-core assets) and investing in growth.

Rolls will ditch its electric flight division and focus entirely on its kerosene burning jet engines as the future of passenger flight.

It’s the latest in aggressive plans by new boss, Tufan Erginbilgic, to turn the company around, growing annual profits up to £2.8bn from £8373 in 2022.

Today’s news follows an announcement last month that the company would cut 2,500 management and admin jobs as part of its cost-cutting plans

And it builds on a major deal with Air India announced in January for airplane engines and servicing.

Specifically, Rolls-Royce was selected to supply engines for Air India's planned acquisition of 250 aircraft over the next decade. The deal is valued at over $5 billion for Rolls-Royce. The British company will provide Trent engine variants to power Air India's upcoming fleet of Airbus and Boeing planes.

The massive Air India order provides significant long-term revenue visibility for Rolls-Royce, which has struggled with the downturn in aviation over the past few years. Aircraft flying hours are integral to Rolls-Royce's business model - as flying hours rise, demand grows for both original equipment sales as well as aftermarket maintenance and servicing.

Over the next decade, the agreement is expected to make Air India one of Rolls-Royce's largest customers worldwide. Beyond the increase in engine demand, the servicing obligations related to all those new planes will generate even larger aftermarket revenues over time.

Investors cheered the news as a sign that Rolls-Royce's prospects in the vital Indian aviation market are stronger than ever. India is poised to become the world's third largest aviation market in the coming years, and Rolls-Royce now appears well-positioned to capitalize.

With flying activity rebounding from pandemic lows, Rolls-Royce has an opportunity to unlock significant cash flows. If engine flying hour activity continues recovering over the next 2-3 years, Rolls-Royce shares likely have further upside from today's levels. Continued progress reducing debt loads and increasing profitability as announced today should also boost the stock.

However, risks remain, including the potential for new COVID-19 variants, energy cost inflation, labour disputes, or airline financial troubles. But with its dominant market share in aviation engines, and the news plans for streamlining the business, Rolls-Royce looks to be on steadier financial footing, making today's pop in the shares well-justified.

While today's pop reflects an improved long-term outlook, Rolls-Royce still faces near-term uncertainty. For traders, it may present opportunities. If you're interested in the merits of short-term trading vs. long-term investing, we invite you to download our free trading ebook:

"10 Reasons Short Term Trading Trumps Long Term Investing Right Now"