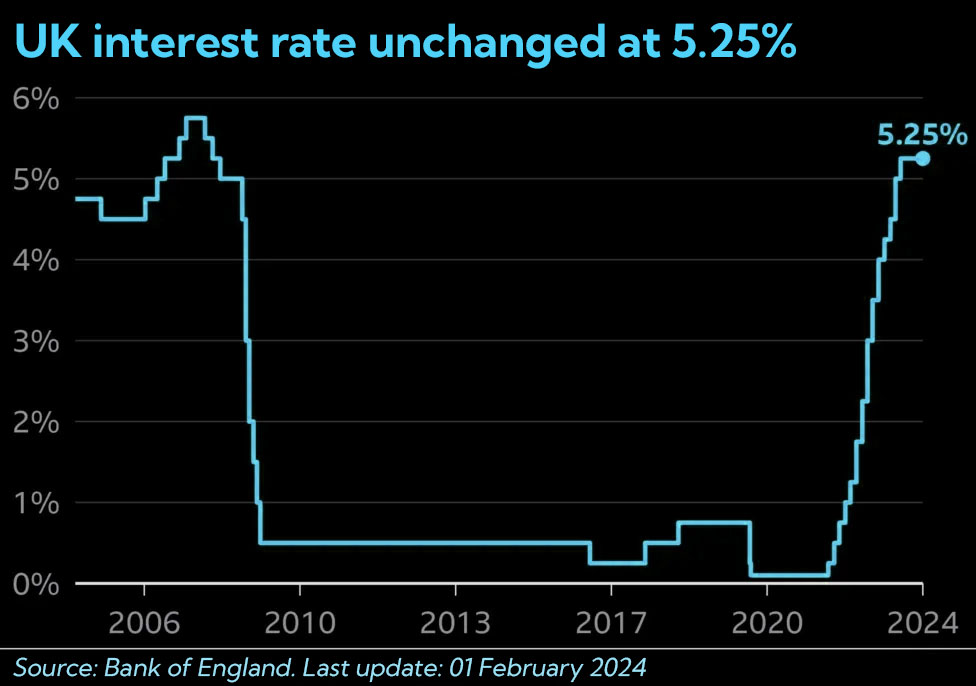

As a trader, it's crucial to keep a close eye on central bank decisions like those from the Bank of England, as they have a significant impact on market dynamics. The recent decision to hold interest rates at 5.25% while hinting at a potential cut underscores the nuanced balance between economic growth and inflation control.

While the Bank's governor, Andrew Bailey, expressed optimism about inflation heading in the right direction, indicating a possible end to rate hikes, it's essential to note that any rate cut may still be months away. The bank is cautiously waiting for concrete evidence that inflation will fall and stabilize around the 2% target before considering a reduction in borrowing costs.

Economists are divided on the timing of potential rate cuts, with some suggesting a cut could happen as soon as June, while others anticipate a more prolonged wait. Factors such as geopolitical risks and the time lag between rate decisions and their impact on the economy add layers of complexity to the situation.

For traders, this uncertainty presents both challenges and opportunities. It's essential to stay informed, analyse market reactions, and adapt strategies accordingly. While the prospect of lower interest rates may stimulate certain sectors, it's crucial to remain vigilant and agile in response to shifting market conditions.

Ultimately, maintaining a disciplined approach to risk management and staying abreast of economic indicators will be key in navigating the evolving landscape shaped by central bank policies. As the market continues to react and adjust, traders must stay focused on their trading objectives while remaining flexible in their tactics.