In the vast landscape of financial markets, chart patterns stand as visual storytellers, seemingly offering a glimpse into the future movements of asset prices. Traders, both seasoned and novice, often turn to these patterns as guiding lights as they learn to trade.

However, a critical question lingers: Do chart patterns genuinely work? In this blog, we'll examine the effectiveness of three popular chart patterns – Head and Shoulders, Double Top and Double Bottom, and Ascending and Descending Triangles – unveiling their potential and addressing the nuances of relying on them in the dynamic world of trading.

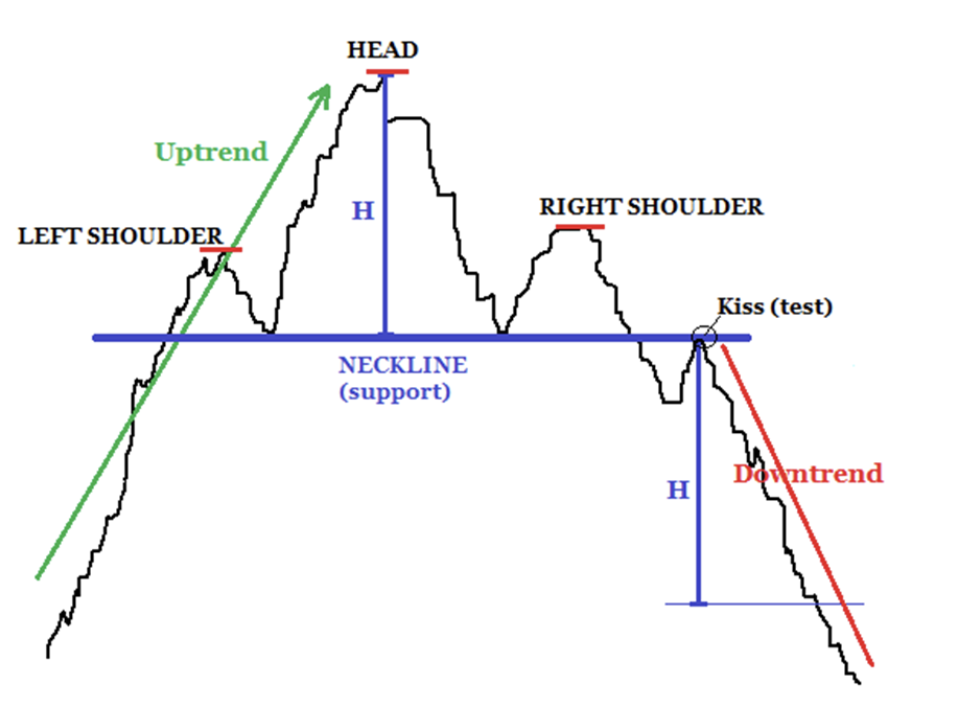

Head and Shoulders: A Reliable Reversal Indicator or a Mirage?

The Head and Shoulders pattern, with its distinct three-peak structure, is hailed as a harbinger of trend reversal.

Traders look for the break below the neckline to confirm a shift from bullish to bearish sentiment. While this pattern has been a staple in technical analysis, sceptics argue that its reliability hinges on perfect execution.

One challenge lies in the identification of the pattern itself – misinterpretation can lead to false signals. Moreover, the market's tendency to evolve can render traditional patterns less effective. When you study the effectiveness of the Head and Shoulders, it becomes evident that successful implementation demands a nuanced understanding, constant adaptation, and possibly even confirmation through additional indicators.

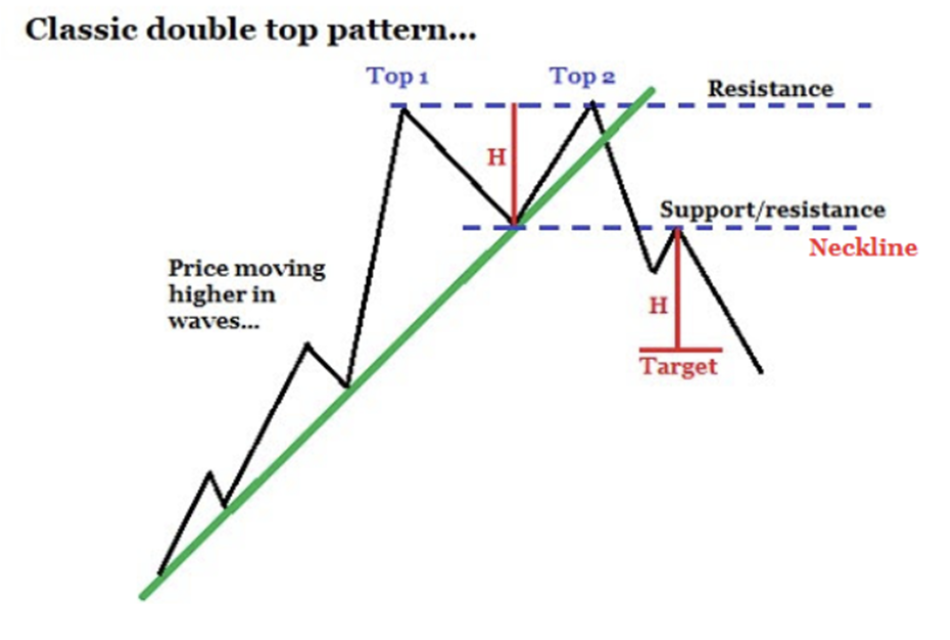

Double Top and Bottom: Symmetry or Statistical Noise?

Double Top and Bottom patterns, showcasing the ebb and flow of market sentiment, are celebrated for their role in signalling trend reversals.

However, in the ever-changing market landscape, their effectiveness can be questioned. Sceptics argue that the symmetrical nature of these patterns might be mere statistical noise rather than a reliable predictor.

The challenge lies in distinguishing between a genuine reversal and a temporary fluctuation. Additionally, the market's susceptibility to external factors and unexpected events can disrupt the expected symmetry.

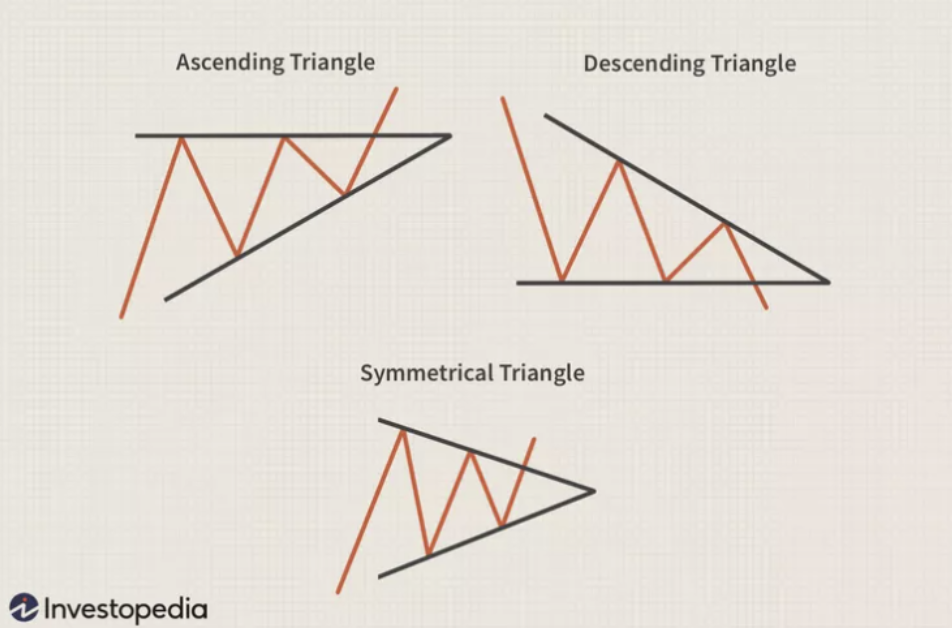

Ascending and Descending Triangles: Do They Truly Herald Continuations?

Ascending and Descending Triangles, signalling trend continuations, are revered for their simplicity and predictive potential.

Yet, the question remains: Do these triangles genuinely provide a roadmap for traders navigating the market's twists and turns?

Critics argue that relying solely on geometric patterns may oversimplify the intricacies of market dynamics. While Ascending and Descending Triangles offer valuable insights into potential trends, the real challenge lies in discerning when market conditions deviate from the expected patterns. Success in using these triangles demands a blend of pattern recognition, adaptability, and a keen awareness of what’s going on in the wider markets.

Conclusion

As we unravel the world of chart patterns, the question persists: Do they really work? The answer lies in a nuanced understanding of their strengths and limitations. While the Head and Shoulders, Double Top and Double Bottom, and Ascending and Descending Triangles have proven their worth, their effectiveness is not absolute.

Traders must approach these patterns with a discerning eye, recognising that the ever-evolving market requires adaptive strategies, confirmation through additional indicators, and a holistic view that considers both technical and fundamental analysis. In the quest for trading success, chart patterns serve as valuable tools, but success ultimately rests on the trader's ability to interpret them within the broader context of market dynamics.

To find out more about the trading courses and strategies we’ve created over the past 20 years to help traders identify high-probability trades without the need to study chart patterns, to manage their risk and to profit from markets, join us in one of our free live sessions.

Register for your FREE session by clicking here.