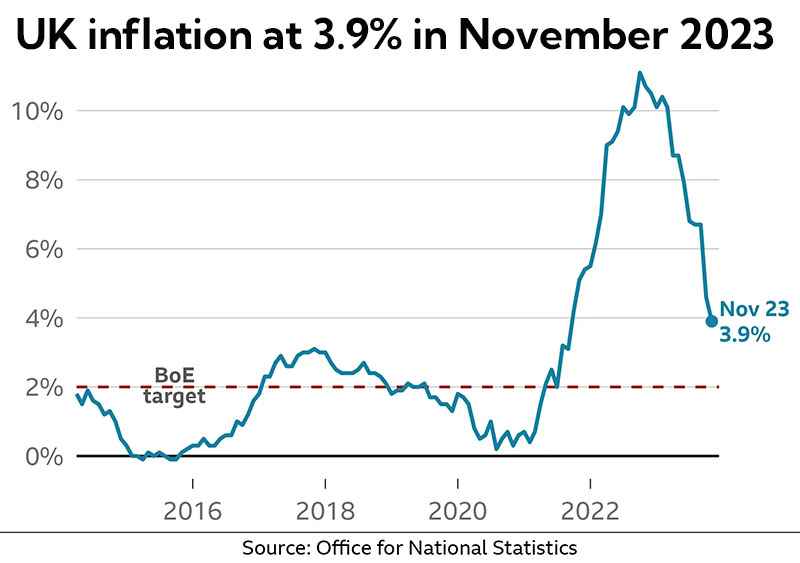

In the recent month, UK inflation has exhibited a decline, surpassing expectations, mainly propelled by a significant reduction in fuel prices. The year-on-year increase was 3.9% in November, down from October's 4.6%. This deceleration extended to essentials such as pasta, milk, butter, and household goods, impacting the overall inflation rate.

While this presents a positive development, it's noteworthy that inflation remains nearly double the Bank of England's 2% target. From our perspective here at Trendsignal, understanding the economic landscape is crucial for traders. The reduction in inflation may influence various sectors, with implications for traders employing diverse strategies.

The decline in fuel prices is particularly relevant for traders keeping an eye on energy-related assets. The volatility in oil prices, driven by geopolitical events, directly affects commodities and, consequently, trading opportunities. As oil prices have retreated, traders may find shifts in related markets, impacting asset valuations.

The ongoing reduction in food price inflation, including staples like bread and cereals, can influence commodities trading. Traders leveraging agricultural commodities should monitor these developments for potential shifts in market dynamics.

However, it's essential for traders to recognise that the broader cost-of-living context includes factors beyond the reported inflation rates. Energy bills and borrowing costs, which may not reflect the declining inflation trend, can impact households and, consequently, trading decisions.

The Bank of England's decision to raise interest rates multiple times and its reluctance to cut rates in the near term should be of interest to traders. This could influence borrowing costs and savings rates, affecting trading strategies in the financial markets.

As the inflation gap between the UK and other countries narrows, traders should be attuned to the global economic context. Trendsignal encourages traders to foster an informed approach to trading.

While the UK inflation reduction signifies a positive economic development, traders should remain vigilant and consider the broader economic landscape when making trading decisions. Staying informed about macroeconomic trends is a cornerstone of successful trading education, and Trendsignal continues to guide traders through these dynamic market conditions.