So, what do we know?

(A forex, index, and commodity market review)

UK markets received unwelcome news as the Bank of England raised rates by 0.5% to 5% as headline inflation remained unchanged whilst core inflation increased to 7.1% versus expectation of 6.7%.

The mutiny in Russia ended as quickly as it started as the leader of the Wagner military group Prigozhin agreed a deal with Putin to stand down. The impact on the markets is unclear as a damaged and weakened Putin could become more unpredictable whilst Ukraine might be emboldened to probe further into Russian controlled territory in their bogged down offensive

Weekly change (amount change and percentage change on the week)

FTSE -180 -2.37%

DAX -527 -3.23%

DOW -571 -1.67%

S&P -61 -1.39%

NASDQ -197 -1.44%

NIKKEI -924 -2.74%

Hang Seng -1,150 -5.74%

Global equities fell last week as investors come to terms with further interest rates rises from major central banks as the inflation outlook becomes more challenging. Last week the Bank of England’s rate setting committee, the MPC, delivered a surprise 0.5% hike in interest rates as inflation and inflationary expectations become more embedded. This follows hot on the heels of a further rate rise from the ECB and prospects for further rates rises from the federal Reserve in the next month.

Core UK inflation pushed the Bank of England to raise rates by 0.5% in a 7-2 vote in favour as the Bank vowed to tackle inflation and bring the rate back to the 2% target. Inevitably there are many critics of the bank’s actions with some accusing the MPC of failing to take decisive action when it mattered. With interest rates now at their highest level since 2008 following the rise, the Governor of the Bank of England, Andrew Bailey, said “We know this is hard — many people with mortgages or loans will be understandably worried about what this means for them,”.

The problem for the Bank of England is that policy adjustments take months to have their full effects and those critics who disagreed with the increase argue that the pain is yet to be felt by mortgage holders who are about to experience a significant increase in their monthly interest payments. Bailey went on to say, “We’re not expecting, we’re not desiring a recession, but we will do what is necessary to bring inflation down to target,”.

Following the news last week, traders now expect UK interest rates to peak at 6.25% early in 2024 as the Bank of England battle to push inflation back to their target rate of 2%. The risk of a recession has now increased as just as recently as three months ago investors were expecting interest rates to peak at 4.7%.

Interesting to note in the annual report from the Bank of International Settlements, often referred to as the central bankers bank, which said that governments should adjust fiscal policy by raising taxes or cutting expenditure to help central bankers fight against inflation.

The problem is that politicians have one eye on their jobs and in the UK for example, the UK government is particularly sensitive to public opinion on mortgage and loan rates and so is unlikely to tighten fiscal policy to help the Bank of England. In fact it is much more likely that the Sunak administration will look to cut taxes when the Bank of England looks to have reversed the course of inflation.

Aside from the UK rate decision there were few data releases last week. The manufacturing and services PMI data which report on the health of both sectors painted a deteriorating picture in manufacturing across all western developed economies as higher rates continue to take their toll. Even more worryingly, service sector data was much weaker than expected, bringing these reading closer to the 50 level which separates expansion from contraction.

EURUSD -0.49 -0.44%

GBPUSD -1.03 -0.80%

USDJPY +1.85 +1.30%

The US dollar ticked higher last week as traders absorbed the outlook for US interest rates into the year end and the rumours late on Friday evening of the unfolding events in Russia concerning the private military Wagner group.

Expectations that rates could rise above 6% in the UK initially pushed sterling to its highest level versus the USD since mid-April 2022. However, the threat of a UK recession has also increased as the Bank of England demonstrates its determination to get inflation back down to the 2% target. Sterling closed out the week at its lowest point as the economic outlook worsens.

Gold -38 -1.94%

UK OIL -2.02 -2.64%

US OIL -2.18 -3.04%

Gold fell further last week as waning demand coupled with a firmer US Dollar pushed gold prices to their lowest level since Mid-March.

Oil markets followed global equities lower as weak Chinese data and a deteriorating interest rate outlook in the west, pressured prices lower.

What don’t we know….yet?

(What traders need to look out for in the week ahead)

A less busy calendar this week with inflation data out from the Eurozone, Canada, Australia, and Japan. We also have Consumer Sentiment data out from the US and central bankers speaking at the Policy panel" at the ECB Forum on Central Banking, in Sintra, Portugal.

Monday

Germany German IFO business climate. Large survey of manufacturers, builders, wholesalers, services, and retailers. Weakening. EUR sensitive.

Tuesday

Canada CPI Inflation data. Expected to fall. Focus on trimmed (core) CPI – expected at 4% from, 4.2% last time. CAD sensitive.

US Core durable goods. Remaining weak. -0.2% expected.

US CB Consumer Confidence. Uptick to 104 expected. Maybe the Federal Reserve outlook on interest rates will have a greater effect than forecast. USD and US assets sensitive.

Wednesday

Australia CPI inflation. Falling further. 5.8% y/y to 6.3% from 6.8% the prior month. AUD sensitive.

Eurozone various central bankers speaking at ECB Forum on Central Banking in Portugal.

Thursday

US Final GDP reading from Q1. 1.4% expected. Little reaction expected.

Friday

China PMI data for manufacturing service sectors. Manufacturing improving albeit below the 50 level whilst services slip further. Global equities sensitive.

Eurozone CPI flash estimates. Release of headline and core inflation rates. Focus will be on Core rate which is expected to tick up to 5.5% from 5.3%. Euro and Euro assets sensitive.

US PCE. Personal Consumption Expenditure. A favourite measure of inflation preferred by the FED to the Regular CPI data. Annual Core PCE expected at +4.8% versus 4.6% last time. USD and US assets sensitive.

What should we be trading?

(Analysis of the popular markets and what we like)

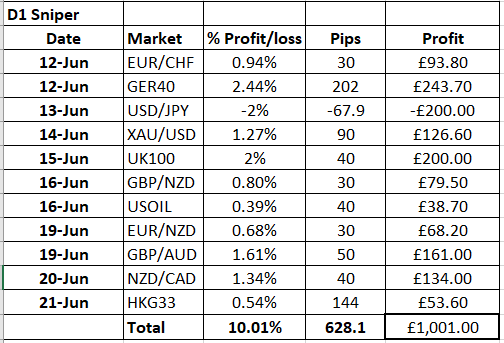

In today’s session we take a look at the trades signalled by the Trendsignal Plus software for the past 2 weeks. There have been some great moves, totally an approx. 10% return. Please see the results in the log below:

What’s the problem?

(Examining a problem many traders face and what to do about it)

Today’s problem is trading a view. What does that mean? It is approaching the market with an opinion about where it will go. The more convinced you are by that opinion the more dangerous it is. For example, if you think stocks will rise over the next month, traders will typically only look for reasons that support that opinion, and discount anything that suggest otherwise. This can make such traders very slow to react to change, often resulting in substantial losses. As discussed in today’s Podcast, more experienced traders will look more objectively at the markets. They will be more open-minded and happy to accept when they are wrong and their trading needs to take a different course. As new information comes in, that could affect the markets, you need to look at it objectively and react accordingly.