Despite robust PMI results exceeding expectations, the U.S. dollar, measured by the DXY index, experienced a dip on Wednesday. S&P Global reported accelerated business activity in both manufacturing and the service sector, with the former entering expansionary territory and the latter achieving its highest level in seven months.

Unexpected Turns in the Market

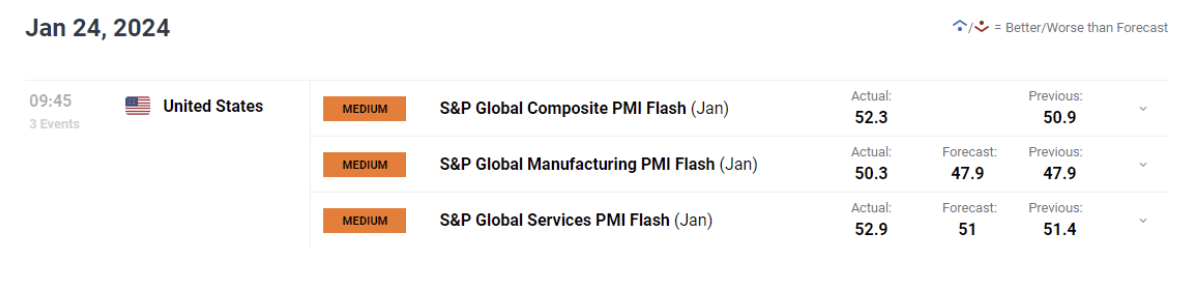

Source: DailyFX Economic Calendar

The accompanying image illustrates the surprising January Flash PMI figures against initial expectations, reflecting the market's response to the upbeat economic indicators.

Temporary Setback or Prolonged Trend?

Despite positive macroeconomic data leading to an initial rise in yields, the U.S. dollar remained in negative territory. This reaction could be temporary. As traders digest the information and reassess the likelihood of the Fed implementing substantial interest rate cuts, there may be potential for the greenback to trend higher once again.

What to Watch Next

Trendsignal emphasises upcoming events, with a keen eye on the US fourth-quarter GDP report set for release on Thursday and December personal consumption expenditures scheduled for Friday. The analysis suggests that if these data points confirm the resilience of the U.S. economy and the persistence of inflationary pressures, the U.S. dollar may stage a moderate comeback heading into the weekend.

By staying informed about the potential resurgence of the U.S. dollar, traders can strategically position themselves in anticipation of market shifts. Trendsignal's commitment to providing actionable information empowers traders to make informed decisions in the ever-changing landscape of global currencies. Whether you're a seasoned investor or just entering the market, Trendsignal equips you with the knowledge to navigate fluctuations and seize opportunities for profitable trading.

Stay connected for real-time updates and valuable insights that can shape your trading strategies.