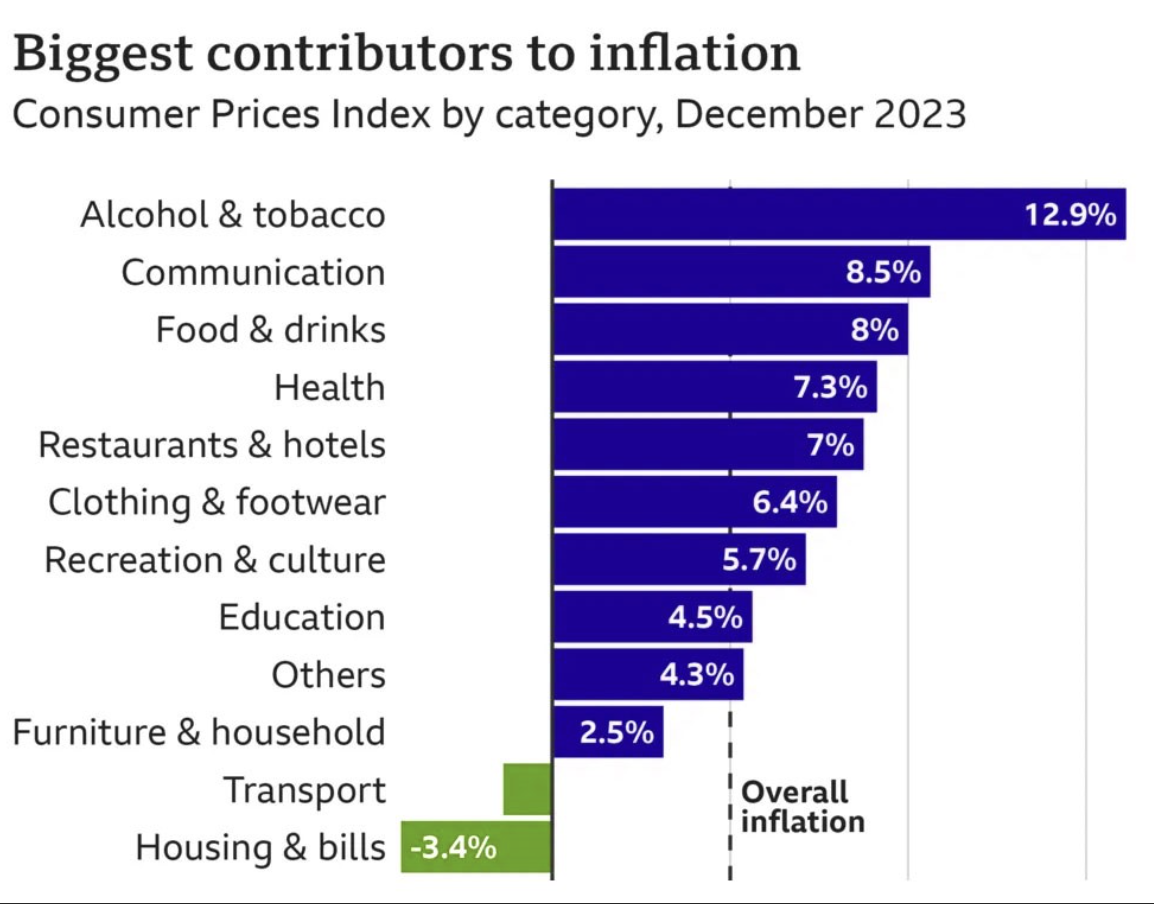

In a surprising turn of events, the UK's inflation rate edged up to 4% in December from 3.9% in November, defying economists' predictions. This unexpected rise was driven by increases in tobacco and alcohol prices. While this might raise concerns among traders, Trendsignal anticipates potential rate cuts later this year, especially with the expected decline in energy bills in 2024.

The Bank of England's aggressive rate hikes aimed to address the rapid price increases in the UK, resulting in the current 15-year high rate of 5.25%. However, given the sharp decline in the inflation rate since its peak in October 2022, coupled with a faster-than-expected fall, financial markets and Trendsignal traders are eyeing a possible base rate cut in 2024.

Source: Office for National Statistics

Economists from Capital Economics project inflation to dip below the Bank's 2% target in April, creating a window for interest rate cuts by June. Samuel Tombs of Pantheon Macroeconomics supports this view, suggesting that falling energy prices could instil confidence in the Bank to make its first rate cut in May or June.

Despite the optimism, there are cautionary notes. Sarah Coles from Hargreaves Lansdown warns of potential disruptions in the supply chain due to conflicts in the Red Sea, possibly leading to higher prices and inflation. The recent redirection of shipping routes, prompted by attacks in the Red Sea, adds complexity to the economic landscape.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), sheds light on the December uptick in inflation, attributing it to higher taxes on tobacco products. While tobacco and alcohol prices saw a notable increase, food price inflation dropped significantly to 8%, offering a silver lining.

As Trendsignal observes these developments, it acknowledges the potential for a bumpy economic path. The rise in December's inflation serves as a reminder of the uncertainties ahead. While Trendsignal remains vigilant, it emphasises the importance of adapting to the dynamic market conditions for successful trading.

Stay tuned for insights and updates as we navigate through these economic shifts together.

- Source: BBC