Dear Fellow Trader,

We all want the rewards from trading. That’s why we do it.

And in this week’s live online trading session, you’ll discover an effective way to do that. Book your free place at the session here.

But here’s an important point...

As you’ll discover in our online session, if you want the rewards, first you need to be smart about risk.

If you’ve been trading a while, you’ll know this.

Perhaps you learned the hard way – by losing more than was comfortable. (I know I did, when I first started trading 20 years ago!)

So, it’s time for a reminder.

And if you’re new to trading, this is even more important for you.

It’s good to start off on the right foot...

That’s why today’s email is all about some lessons we can all do well to take on board.

First up...

Keep your losses small

Trading is about making money. We’re looking to profit from asset prices going up or down.

But to do that, we must put our money at risk.

There is no reward without risk.

And typically, the higher the rewards you want, the higher the risk you must take.

If you want to take very little risk, keep your money in a savings account or in a fixed bond.

It’s very unlikely (though not impossible) that you’ll lose money by putting it there.

But you won’t make much either.

Stick £1,000 in an easy access savings account for a year and you can expect to make, what, 1.5% or £15 on it.

You can get a little more in a fixed bond. Say, 2.5% over the year. But only if you leave it there and don’t touch it.

The higher the risk, the greater the potential rewards

If you put some money in a fund that tracks the stock market, you could make 5%, 10% or more in a year if the market is in bullish mode (i.e. trending up).

But on the other hand, you could lose 5%, 10% or more if the good times end and stock markets fall...

Which, given all the stuff going on in the word (Trump’s trade wars, Brexit, rising oil prices, etc.) is a very real risk!

And how about ratcheting up your risk even more... to go for even faster, FATTER rewards!?

You’ve probably heard tales of lucky Bitcoin and crypto traders making tens of thousands of percent profits on their cryptocurrencies (back in the good old days of 2016/17).

But they had to have gotten into them AND out of them at the right time... and many didn’t.

Sure, you could have turned a £1,000 Bitcoin punt into many thousands of pounds if you got in early… and sold before it crashed.

But as with all manias, the price DID crash.

And latecomers to the party in December 2017 saw 90% of their investment wiped out by December 2018.

Imagine seeing your £1,000 ‘investment’ turn into £100 in the space of a year!

By the way, I’m not questioning whether Bitcoin or cryptos have a future. Perhaps they will.

And maybe there is a lot of money to be made by owning them in the years ahead. They’ve certainly been rising for the past five months.

Degrees of risk and safeguarding your money

My point is, investing and trading is all about degrees of risk versus degrees of potential return.

And most important of all when we’re talking about trading is to try to minimise your losses to safeguard your hard-earned money. (I’ll explain more about this in this week’s free live trading session.)

In any sort of trading, you’re going to have some losses along the way, whatever your strategy is.

So, it’s essential to manage your risk and keep your losses in check.

Think of it like this: All losses start out as small losses.

And it’s up to you whether they turn into big ones.

Let’s think about this with an illustration.

To keep it simple, I’ll base it on investing directly in shares, rather than trading a derivative such as spread betting.

Let’s say you pick a decent share on average two times out of every three and achieve gains of 25%.

You lose money on every third share. But rather than deal with them, you ignore that they are losing in the hope that they will ‘come right’.

That’s where the problems start.

One day you check up on your portfolio and find that one of the companies you invested in has gone bust.

You’ve lost 100% of your investment in that share.

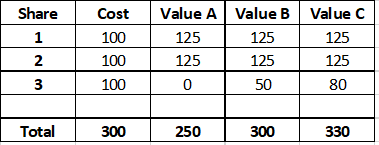

So, your portfolio looks like this (Value A):

So, your investment of 300 across the three shares has fallen to 250 – a drop of 16.7%.

It’s not a catastrophe. And by spreading your investment across three different shares (diversification), you have mitigated your risk to a degree.

Imagine you had put the whole 300 into share 3 – you’d have lost the lot.

But given that you have a pretty good success rate (2 out of 3 winners or 66.6%), you might hope for a better result.

Improving your results by limiting risk

Now look at the other columns to see how you could have improved your outcome by managing your risk a little better.

Column 3 shows the same exercise, but where you decide to cut your position in any share that loses 50% of its value.

Same again, but this time you still have all your original investment across the portfolio.

Again, you have that decent 66.6% strike rate. But you’re not making money from it! Just breaking even.

But look what happens in column 3. This is where you tweak your ‘stop loss’ to make sure that you exit positions showing a 20% loss (rather than 50%).

And this time – again with a 66.6% strike rate because of one out of three trades losing money – you come out ahead.

By keeping a lid on your risk, you come out ahead by 10%.

That’s lesson one.

Understand the maths of making up for losses

So, the solution is to get tough on losers.

They are standing between your proven success (66.6% strike rate!) and the results you deserve.

And remember... it’s harder than you might think to come back from a big loss on any one trade.

Here’s the maths you need to understand:

A 25% loss requires a 33% gain to get back to breakeven.

A 50% loss requires a 100% gain to get back to breakeven.

A 75% loss requires a 300% gain to get back to breakeven.

A 90% loss requires 900% gain to get back to breakeven.

OK, so a 66.6% strike rate is good. And making 25% returns on 2 out of 3 trades is great.

But that’s not the same as making 100%+ or 300% gainers on a regular basis.

So, don’t risk losing 50% or 75% on a trade… you’ll soon end up in the poorhouse!

By the way, I based that list on losses on individual shares.

But it applies just as much if we’re talking about your trading account: lose 75% of your bank and you must gain 300% to get back to where you were.

It’s worth remembering.

OK, so that’s a bit about risk and how you should treat losses.

It’s all about those two golden words: risk management.

Risk management is about protecting your capital and ensuring you can trade again tomorrow.

It’s about making sure that your (inevitable) losses don’t wipe out your account.

It’s also the key to creating a profitable strategy and becoming a consistently profitable trader. And consistency is the key word here.

Revelation: You don’t need to make 1000-pip trades to make money

People often think that to be a profitable trader, you need to be making 1,000-pip trades on a regular basis.

And understandably, that sounds out of reach of most traders. No wonder people are put off.

But what if I told you that you could be a highly profitable trader by just banking 20 pips profit per day?

Given that many currency pairs and stock indexes move more than that in a few hours most days, that sounds more achievable doesn’t it?

And ok, you might want to go for bigger moves than 20 points. Believe me, once you start trading and seeing your profits come in, you WILL want to go for more… it’s natural!

If you’d like to see how, join me in this week’s live trading session.

I’ll show you exactly what I mean – and teach you the award-winning Sniper trading strategy that these three of our members are using to profit from the markets:

“I started with a £5k account and have tripled my balance in 3 years.” – Sniper user, Chris S

“My account has grown by 24.5% in three weeks.” – Sniper user, S Briggs

“In the last three months the return on my account is 130%.” – Sniper user, P Freedman

Please note: Places for this session are strictly limited.

So, if you’d like to get a place for the event, you should do so now (it takes seconds to get your name down).

Click here now to collect your free live event pass.

20 pips a day – you can do that... IF you have the right system. And that’s what I’ll show you in my session.

Make sure you get a place and I’ll see you online.

Understanding and respecting risk is important. And it’s not something to be afraid of either… just treat it as part of trading... just like the rewards.

You can’t have one without the other…

Kind regards,

Adrian Buthee

Head of Trading

Trendsignal

P.S. While 20 pips a day sounds attractive... and very achievable, that’s not the limit to our strategy..

In fact, over the past five years, our Sniper strategy has averaged 950 pips per month profit..

And we hear from members all the time who are taking far more on than that, like Graham here:

“Through a simple end-of-day strategy and employing the sensible risk-management I have been taught, I am currently almost 3,000 pips up after just 3 months of live trading – all for less than an hour a day of effort. Anyone who can follow a few well-defined rules with diligence and patience can do this.” – Graham B., Trendsignal Trader

And by the way, Graham discovered this system by tuning into my live trading session. If he hadn’t, he may still be floundering... or wondering how to get started in trading profitably.

That’s why I’d like YOU to join us in this week’s live session – so you have the chance to do what Graham is doing.

There’s a free place for you at the session. But you must reserve your spot in advance.

See you there.

|